Planning for retirement can feel overwhelming, but one of the most powerful tools available is the Individual Retirement Account (IRA). Whether you choose a Traditional IRA or a Roth IRA, both offer unique tax benefits that can help you grow wealth and prepare for the future. In this guide, we’ll break down how IRAs work, compare Traditional vs. Roth IRAs, and explore when an IRA might or might not be the right fit for you.

What Is an IRA?

An Individual Retirement Account (IRA) is a tax-advantaged savings account designed to help individuals build retirement funds. The main benefit of an IRA is its tax advantages — either through immediate tax deductions (Traditional IRA) or tax-free withdrawals in retirement (Roth IRA).

💡 If you want to learn more about managing your tax liability, check out our guide on tax planning strategies.

Traditional IRA: Tax Savings Today

A Traditional IRA (Individual Retirement Account) is a retirement savings account that lets you set aside money for your future while giving you a tax break today. It’s one of the most popular retirement options in the U.S.

Here’s how it works, in simple terms:

✅ Key Points About a Traditional IRA

1. Contributions (Money You Put In):

You may be able to deduct your contributions from your taxable income.

Example: If you earn $60,000 and put $6,000 into a Traditional IRA, you might only pay taxes on $54,000.

2. Growth:

The money grows tax-deferred. That means you don’t pay taxes on interest, dividends, or investment gains while the money stays in the account.

3. Withdrawals (Taking Money Out):

After age 59½, you can withdraw without penalty, but you’ll pay regular income tax on what you take out. If you withdraw before age 59½, you usually owe income tax plus a 10% penalty, unless you qualify for an exception (such as a first-time home purchase, education, or medical expenses).

4. Required Minimum Distributions (RMDs):

Starting at age 73, you are required to withdraw a certain amount each year, even if you don’t need the money.

5. Contribution Limits (2025):

You can put in up to $7,000 per year if you’re under 50. If you’re 50 or older, you can put in $8,000 (extra “catch-up” contribution)

💡 Best for: People who expect to be in a lower tax bracket during retirement.

👉 Want to explore more? Read our guide on Top Tax Deductions Every Business Owner Should Know.

Roth IRA: Tax-Free Retirement Income

A Roth IRA (Individual Retirement Account) is a special type of retirement account that lets your money grow completely tax-free. Unlike a Traditional IRA, you don’t get a tax break when you put the money in, but the big advantage comes later—you won’t pay any taxes on your withdrawals in retirement (if you follow the rules).

✅ Key Points About a Roth IRA

1. Contributions (Money You Put In):

You contribute money you’ve already paid taxes on (after-tax dollars). No tax deduction today.

2. Growth:

Your investments grow tax-free—you won’t owe any tax on interest, dividends, or gains.

3. Withdrawals (Taking Money Out):

Contributions (the money you put in) can be taken out anytime, tax-and penalty-free. Earnings (the growth on your money) can be withdrawn tax-free at age 59½, as long as the account has been open for at least 5 years. If you take out earnings too early, you might owe taxes + 10% penalty (some exceptions apply).

4. Required Minimum Distributions (RMDs):

No RMDs during your lifetime. This means you can let your money keep growing tax-free for as long as you want.

5. Contribution Limits (2025):

- Up to $7,000 per year if you’re under 50.

- Up to $8,000 per year if you’re 50 or older.

- Income limits apply: if you earn too much, you may not be able to contribute directly.

💡 Best for: People who expect to be in a higher tax bracket in the future.

👉 Learn more about tax-free retirement income strategies here.

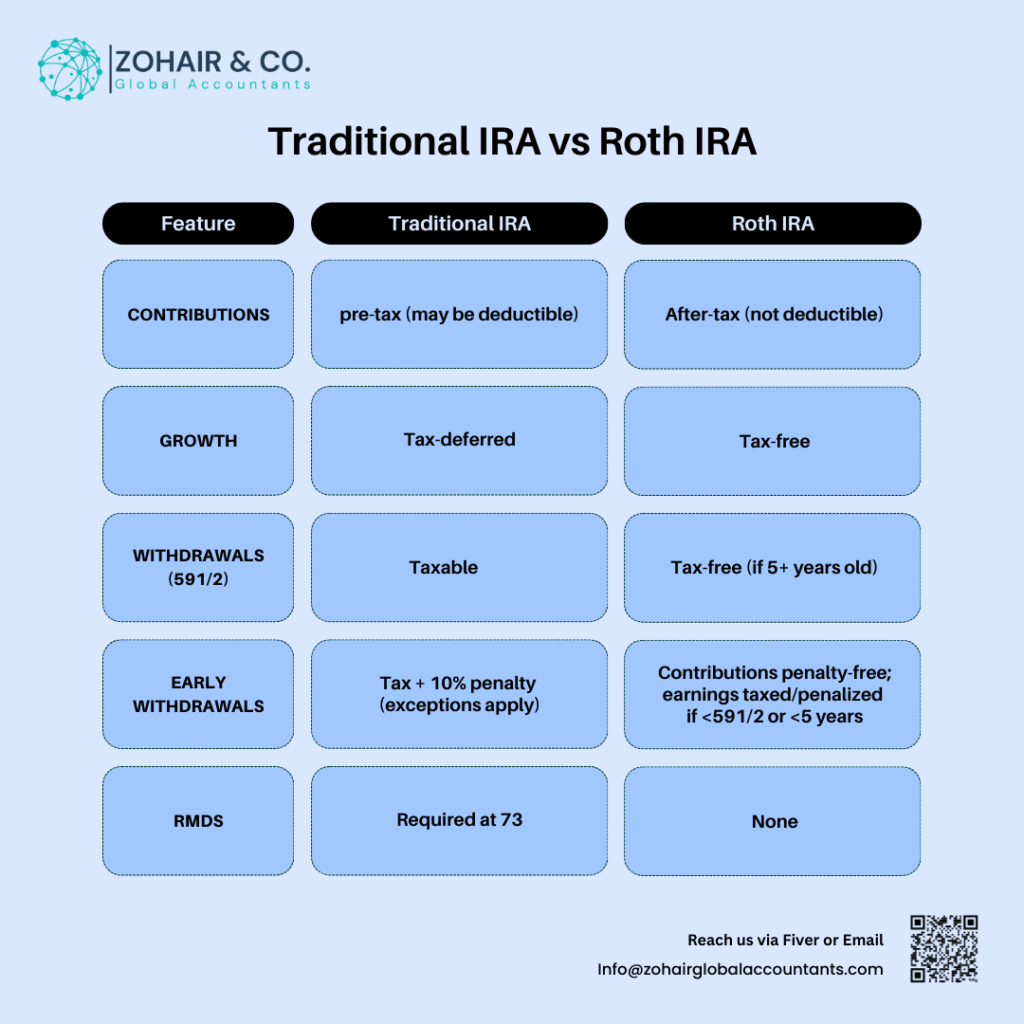

Side-by-Side Comparison: Traditional vs Roth IRA

The infographic above summarizes the key differences between Traditional IRAs and Roth IRAs — including contributions, growth, withdrawals, and early withdrawal rules.

IRA Contribution Limits (2025)

- Contribution limit (both IRAs combined): $7,000 (under age 50) and $8,000 (age 50 or older).

- Traditional IRA deduction phase-out: Begins at $77,000 (single filers covered by a workplace plan).

- Roth IRA contribution phase-out: Begins at $146,000 (single) and $230,000 (married filing jointly).

When an IRA Is a Smart Choice

An IRA is an excellent option when:

✅ You don’t have a workplace retirement plan like a 401(k).

✅ You want to grow money tax-deferred (Traditional) or tax-free (Roth).

✅ You’re committed to leaving investments untouched until at least age 59½.

✅ You’ve maxed out your employer’s 401(k) match and still want to save more.

When an IRA Might Not Be Worth It

Consider alternatives if:

❌ You have high-interest debt (paying that off first is smarter).

❌ You’ll need money before retirement — penalties can be costly.

❌ You’re in a very low tax bracket now and expect the same later.

❌ A 401(k) with a match offers better benefits.

❌ Your income is too high for IRA deductions (though you may explore a backdoor Roth IRA strategy).

Which IRA Should You Choose?

Traditional IRA → Better for upfront tax savings and lower income in retirement.

Roth IRA → Better for long-term tax-free withdrawals and higher expected income later.

👉 For a full comparison, see our guide on 401(k) vs IRA: Which One Should You Choose?

Final Thoughts

An Individual Retirement Account (IRA) is one of the best tools to build retirement savings while reducing your tax burden. The key is choosing the type that aligns with your financial situation and tax outlook.

By understanding how Traditional and Roth IRAs work, you can grow your retirement fund strategically, avoid costly mistakes, and create a stronger financial future.

💡 Ready to Maximize Your Retirement Savings?

Choosing between a Traditional IRA and a Roth IRA doesn’t have to be confusing.

The team at Zohair & Co. Global Accountants is here to help you create a personalized retirement strategy that maximizes your savings and minimizes your tax liability.

👉 Our experts can help you:

- Select the IRA that fits your goals

- Reduce your tax liability today and in retirement

- Build a personalized retirement savings plan

Let’s build your secure financial future together.

Contact Zohair & Co. for a personalized plan. (https://info@zohairglobalaccountants.com)

📞 Book Your Free Consultation Today.